The modem pool at PC Shopping Network may be upgraded. It was last renovated two years ago, spending $170 million on equipment with a 5-year expected life and a $20 million salvage value for tax purposes. Straight-line depreciation is used by the company. The obsolete equipment is currently worth $120 million. For $210 million, a new modern pool can be built right now. This will be depreciated to zero over a three-year period using straight-line depreciation. The new equipment will allow the company to raise sales by $22 million per year while lowering operational costs by $11 million. The new equipment will be worthless in three years. Assume that the firm’s tax rate is 35% and that the discount rate for projects like this is 11%.

Our Advantage

|

Recent Posts

Recent Comments

Archives

- April 2025

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- March 2020

- February 2020

- January 2020

- December 2019

- February 2019

- December 2018

- March 2018

Categories

- (ASA) style

- (Author, Date)

- (Bell, p.27)

- (Oxford). Look at the exampel PDF file.

- ++notepad

- –

- 1. The essay must be typed, using: Arial 11pt. font (12 pt. for headings) 1.5 spacing blocked (justified) layout (excluding the

- 1.5 space

- 12 Font times new roman

- 12 size font TimesNewRoman. 1inch Margin. DoubleSpaced

- 12 Times New Roman

- 1st year Statistics

- 2 pages. A heading. No spacing between lines and paragraphs.

- 2 texts first: the headline which needs 122 words. and the other text is the summary feel free write until the end of the same

- 3

- 5-6 paragraphs

- 8th edition style

- 9th edition Turabian

- A cylindrical pill-like cluster of radius r nucl

- AAA

- Abnormal psychology and life

- Accounting Research Memo

- Acknowledgments I sincerely thank my family who has supported me in my journey towards finishing my doctoral dissertation. I w

- ACS

- ACS Style

- ACS style guide

- Actuarial Mathematics

- Adaptive Psychology

- Add footnotes

- Adobe Creative Suite (After effects and Illustrator)

- Aerospace Engineering

- AGLC-4

- AGLC4

- Airline management

- Algorithms

- all u need is to watch the video

- AMA

- AMERICAN INSTITUTE OF PHYSICS

- American Sociological Association (ASA) Style Guide, 6th Edition

- anaconda

- Analytical Chemistry

- Analytics

- animal science

- answer each of the following questions in short paragraphs.

- answer format

- answer questions

- answering a set of questions

- ANT

- anthropology

- any

- Any Ruby IDE

- anything. I personally use IntellJ IDEA for java

- AP

- AP style

- APA

- APA (edition "APA 6")

- APA (edition "APA 7")

- Apa 7

- APA 7TH

- apa 7th edition

- APA citations

- apa7

- Applied Sciences

- APSA

- Architecture and Design

- Architecture and engineering

- Art

- Art

- Art Appreciation

- art history

- Artificial Intelligence

- As described in the referencing file

- As the prompt says

- ASA

- ASA format

- ASCE

- ASIAN STUDY or MUSIC (CANTONESE MUSIC)

- ASR

- Astrology

- Astronomy lab

- Attached

- Auditing

- Australian legal guide citation

- Australian legal guide citation 4th edition

- AutoCad

- AutoCad or Rhino

- awk, computer science

- BankingSystem

- Basic C++ Project Assignenment

- Beauty business

- Behavioral and Community health

- bio mechanic injury accident

- Bio-medical ethics

- biochemistry

- Biol Anthropology & Prehistory

- Biological sciences writing

- Biology

- Biology

- Biology – Anatomy

- Biology – Ecology

- Biology – Physiology

- Biomedical Engineering

- block business letter format

- Block Format

- blog

- Blue Book

- Blue Book citation

- Bluebook

- BLUEJ

- Book

- book report

- Business

- Business & Finance

- Business & Finance – Financial markets

- Business & Finance – Marketing

- Business – Inferential

- Business Administration. Healthcare administration

- Business and Management

- business and marketing concept

- Business calculus

- Business Finance

- Business Finance – Accounting

- Business Finance – Economics

- Business Finance – Management

- Business Finance – Operations Management

- Business Management

- Business Professional Guidelines

- Business strategy

- Business writing

- C or C++

- C program

- C# Object oriented programe in visual studio

- C#, Visual Studio

- C++

- C++ BMI Calculation code

- C++ Computer Science

- C++ Programming

- Calculus

- Can be done in question/answer format

- CANADA

- CANVA

- case study

- catia,solid works

- Cell and molecular biology

- CFA

- Check image

- Chemical Engineering

- Chemistry

- Chemistry

- Chemistry – Chemical Engineering

- Chemistry – Organic chemistry

- Chemistry – Pharmacology

- Chemistry 101

- chiago

- chicago

- Chicago / Turabian

- Child development

- Children and Studies Course

- Children And Youth Studies

- citation-yes, format-none

- Cite all sources you use to avoid plagiarism). Use the text as your primary source and at least one academic secondary source.

- Citing Harvard Style manual

- Civil Engineering

- CLEAR AND CONCISE

- Clinical Mental Health Counseling

- CMS

- Code Blocks

- codeblocks

- Coding

- Coding – C# (Visual Studio)

- coding/numerical analysis

- Cognition and Memory

- COGNITIVE PSYCHOLOGY

- College Admissions paper – my personal story

- College Algebra

- Commemorative Speech/ Prompt

- Communication

- Communication

- Communication and media theories

- Communications

- Compare and contrast essay

- Computer Design

- Computer engineering

- Computer Networks

- Computer Scicence, Java, JavaFX

- Computer Scicence, Java, SceneBuilder

- Computer Scicence, Java,JavaFX

- Computer Scicence, python

- Computer Science

- computer science

- Computer science and IT assignments

- Computer Science App lab Create PT project

- Corporate Finance

- cost accounting,

- counseling

- Coursework

- Cover letter. Single spaced.

- Criminal

- Criminal Justice

- Criminolgy

- Criminology

- Crisis Counseling

- Critical Thinking

- CSE

- CSE numeric citation format.

- CU Harvard

- current event

- Cyber Security

- cyber terrorism

- Dance

- Data Analysis

- Data analysis and reports

- Data analytic, Programming

- Data base design and management

- Data Management

- Data Science/ R Studio

- Data Structures

- Database design and optimisation

- Deakin Harvard Referencing

- Deakin Havard

- Department of History house style

- Design, usability and mockups

- Desktop software development

- Dialogue format

- differential equations

- Digital Media and Web Technology

- Discrete Math

- Discrete Mathematics

- discussion

- discussion comment

- discussion post

- disscusstion

- Diversity

- django

- Don’t know what that is

- double spaced

- double spaced with one-inch margins Outline typed in 12-point type with Times New Roman Numbered pages

- e

- E business Application Development

- Earth Science – Geography

- Earth Science – Geology

- Ecology

- Economics

- Education

- Electrical Engineering

- electrical measurements

- electrical power, drift velocity and internal resistance

- electricity

- Electricity and magnetism

- Electromagnetism

- Electromagnetism/Semiconductors

- End note software and APA, but you have to use the end note software

- Energy systems engineering

- Engineering

- Engineering – Electronic Engineering

- Engineering – Mechanical Engineering

- Engineering – Telecommunications Engineering

- Engineering mathematics/physics

- English

- English – Article writing

- English and Literature

- English essay writing

- English research paper in MLA format

- Entrepreneurship

- environment

- Environmental

- Environmental science

- Epidemiology and health informatics

- equilibrium chemical reaction:

- Equity Research report or SWOT analysis models

- Essay

- essay form

- essay writing

- Esthetician Industry

- Estimating the cost of capital

- Ethical concerns of computer scientists

- Ethnomusicology citation style

- Exam

- Excel

- Excel and word document

- Excel Crystal Ball and Microsoft Word.

- EXCEL or SPSS

- excel.word

- facts/ topic point

- Fashion Merchandising

- FCO

- FDA regulation

- Fedora on virtualbox

- File Attached: "Classics UGrad Referencing Guide"

- Film and Genre

- Film Studies

- Final Project

- Final Project Powerpoint

- Final Project Presentation

- Finance Management

- Financial Accounting

- Financial Accounting for Managers

- Financial Management

- Financial statement analysis

- financial statements

- Follow "Edit Here" File

- Footnote

- Footnotes

- footnotes, bibliography and a discography.

- Force

- Foreign Languages – Spanish

- Forensic Accounting

- Forensic and criminal investigation

- Formal letter

- format is not important

- Fourier

- Fourier Transform

- free

- Free Response

- Functional Analysis

- Game Design Programming

- Games Programing

- Gatton

- GCC Compiler

- Genetics

- Geography

- Geology

- Geometry

- Google document

- google sites

- google slides

- Government

- Graduate

- GSA

- Hacker Culture

- Hadvard

- Hard News

- hardvard

- Harvad

- harvad referencing

- Harvaed

- Harvar Style

- Harvard

- Harvard (AGPS)

- harvard at newcastle

- Harvard Citation

- Harvard citation format

- Harvard Coventry

- harvard format

- harvard gatton

- Harvard in-text referencing

- Harvard or IEEE

- Harvard or Vancouver

- Harvard reference

- Harvard Reference List

- Harvard references system

- Harvard Referencing

- Harvard Referencing Style

- Harvard Referencing System

- harvard referncing

- Harvard Refrencing

- Harvard Style

- Harvard style of referencing and in-text citation

- Harvard style referencing

- Harvard style referencing (inline references in the body of the text and a reference section at the end)

- Harvards leeds

- Harverd

- Harverd Citation Style

- Harward

- Harward Referencing Style

- harward style

- Havard

- HAVARD 25 Sources

- havard gatton

- Havard Style

- Havard style/ also text citation

- Haward

- Health

- Health Care and Life Sciences

- Health informatics and epidemiology

- health physics society journal

- Healthcare

- Healthcare Economics

- Healthcare Op. Management

- High School

- High school

- History

- History

- History – American history

- History – Ancient history

- History – World history

- History civilization

- Homework

- Horner's method, polynomial and cubic interpolants

- Hospitality

- Host Scripting/ Python

- How to Cite When citing an author, just quote the text, footnote it, and reference the author and the title of the piece you’re

- https://citruscollege.instructure.com/courses/16700/modules

- Human Resource Management

- Human Resources

- Human Resources Management

- Humanities

- I think unix i'm not sure

- iCite

- ICMJE

- Identify and briefly explain

- IEEE

- IEEE citation

- IEEE format

- IEEE or ACM

- ieee reference

- in c++

- in instructions

- In instructions, pretty sure it’s word? I copied and pasted what she said there

- in-citation (author, page number)

- in-cite citation only, author's name and page number only (Johnson, 11).

- in-text citation only (author's name and page number)

- in-text citation only (Smith, 100).

- In-text citation with author's last name and page number, only. Ex: (Smith, 100)

- In-text citation with only author's last name and the page number. ex: (Smith, 100).

- In-text citation with only author's last name and the page number. ex: (Smith, 100). Or Name and video name.

- Industrial Engineering

- Inforgraphic

- Information Systems

- Information technology

- Intelij

- IntelliJ

- Intermediate Macroeconomic Theory and Policy

- International Finance

- International Management

- International Relations

- Internet

- Internet of Things, Arduino

- Intro chem

- Intro to Calculus

- Intro to statistics

- Introductory

- investment

- Investments

- IRAC

- IRAC MODEL

- Irish Historical Studies

- IT consulting

- IT project management

- IWG

- java

- java app

- Java coding

- Java Console Game

- Java Open GL Program

- Java Programming

- Javascript

- Journal

- Journal of management style

- Jupyter Labs and Zybooks

- just answer questions

- Just answer the questions.

- Just copy links from websites used as sources, websites are all that is needed.

- Just need website URLs

- just note it

- Just write Q&A

- Kinematics

- Lab

- Lab Experiment

- Lab Report

- Landscape architecture

- language arts

- Law

- Law – Criminal

- Law, regulations, & the workplace

- Law, Technology and Culture

- Leadership

- Leadership and Change Initiatives in an International Context

- Letter of intent

- Life and Health Insurance

- like a discussion

- List key references at the end of report

- Literature

- Logistics

- Machine learning

- Macroeconomics

- Make a Comment

- Management

- Management and Organization Theory

- Managerial Accounting

- Marine Engineering

- Marketing

- marketing

- Master's

- Master's Level

- Masters in Electronic Information Engineering

- MAT2001

- Materials Science

- math

- math 1064

- math physics

- Mathematics

- Mathematics – Algebra

- Mathematics – Geometry

- Mathematics – Precalculus

- Mathematics – Statistics

- Mathematics and Physics

- Mathematics and Statistics

- MATLAB

- Matlab unit conversion

- MATLAB, powerpoint

- Mechanical Engineering

- Mechanics

- Mechatronics/Robotics

- Medical Legal Issues

- Medicinal Chemistry

- Memo

- Memo Format

- Memorandum format single spacing

- mental health

- MHRA

- MHRA Style

- Microbiology

- Microeconomics assessment

- Microprocessor

- Microservices SpringFramework

- Microsoft Excel

- Microsoft office POWERPOINT

- Microsoft Word

- Military Science

- MLA

- MLA ( format 8th edition )

- MLA CITATION

- MLA Format

- MLA or APA

- MMU Harvard

- Mobile applications development

- Money and Banking

- MSWord format

- Multi Media Production

- multimedia

- multimedia/Video

- Music

- Music and history

- Music appreciation

- N/A

- Na

- Na

- narrative

- narrative format

- Natural science

- netbeans

- Networking

- NLM

- no

- no citation

- No citation needed

- no citation required

- no cite

- no format

- no format needed

- no format required

- no heading or format, just start writing

- no need

- no need for citation its just a reflection on the movie

- no need to cite, just make it at least 1000 words, yes, 1000.

- NO REFERENCES ARE REQUIRED.

- no requirement

- no requirements

- no specific format

- No specific Format or citation style is required

- no style

- no style just answer questio

- non

- none

- None really necessary, since it is a paper I have to present

- None, only if using other resources

- normal

- normal writing

- Not applicable

- Not applicable i

- not applicable unless you're citing

- not required

- Not set

- Not sure yet

- Note each source you use by adding parenthesis and the name of the source at the end of the sentence or question

- nothing

- number the questions 1, 2, 3, 4

- Numerical Analysis

- Numerical Computing

- Numerical Methods

- Nursing

- Nursing – informatics

- Nursing research paper

- Nutrition

- Online require

- only in-cite citation, name and page number only.

- only typing the answer

- operating systems

- Operational Simulation

- Oral speech

- Organic Chemistry

- organic chemistry 2

- Organic Chemistry SN2/E2, SN1/E1 Mechanisms

- OSCOLA

- OSCOLA References system

- Oscola referencing

- Oscola/ Footnote style refrencing

- Other

- other

- Outline sentence

- Packet Tracer

- paper review

- paragrahs

- paragraph

- Parallel computing

- parenthetical

- parenthetical citation

- Pascal's Principle

- Personal Finance

- Philosophy

- Philosophy

- photonics

- Physical activity

- Physics

- Physics

- Plasma Physics

- PLAY RESPONSES.

- please see the instruction

- Please write back if you can’t open links right away

- poem

- Poem stanzas (no double space needed)

- Political science

- poster

- Potensial, Mechanical and Electrical

- Power point

- Power Point Presentation

- power point presentations and word

- Power Point Slides and Speech

- powerpoint

- Powerpoint/or Google Slides

- Powtoon presentation needed

- Pre-Calculus

- Predictive Analytics JMP

- Presentation

- Pressure and Force

- probability

- Probability MAPLE CODING

- Problem solving

- Processing

- programming

- Programming C/C++

- Programming for animation

- programming fundamentals

- programming languages

- programming notebook

- Programming- Python

- Project Management

- Prolog

- Proposal

- Provided in attached document

- Pseudocode

- Psychology

- psychology

- Psychology and Education

- Psychology of abnormal behavior

- Public Administration

- Public Health

- Public Health

- Public Relations

- Purdue OWL – MLA format

- PYTHON

- Python coding

- Python IDLE Assignment

- Python Programming

- Python, visual studio code

- Python/IT

- QA and software testing

- Quantitative & Excel

- quantitative analysis for program evaluation or policy analysis

- Quantitative Design and Analysis

- Quiz

- quotes

- R programming

- R studio

- radioactivity

- read the assignment guideline

- Reading

- Real Estate Development/Urban Planning

- redesign

- references author name, “year”, publisher details”

- references to the exact pages of the text used as evidence of your argument

- Rehabilitation Services

- Religion / Theology

- reply to discussion prompt & response to classmate’s discussion comment

- requirement are below

- Research

- Research Project

- resume format

- RGU Harvard

- RGU Harvard referencing

- RGU harvard style

- Risk Register

- RMIT Harvard Referencing

- SAA

- Saplinelearning.com

- School counseling

- school project

- Science

- Scientific writing

- script

- See above instructions, single spaced, 1000 words. Link: https://book-finder.site/book.php?i=17&g=book&b=446252&n=

- See attached Assignment example for format.

- see below

- See citation format to be used attached

- see example

- see instructions

- See notes

- see the instruction.

- Servers setup and administration

- Shooting script style in 2 columns

- Short answer

- short answers

- short responses

- Simple knn classifier for a uni project

- simulator

- single space

- Single spaced

- single spaced, APA format for citations

- Single spaced. Times New Romans, 12

- Smart cities engineering (sustainable engineering)

- Social Accounting

- Social Science

- Social Science – Philosophy

- Social Science – Sociology

- Social Sciences

- Sociology

- Sociology assignment

- Software Engineering

- Software Engineering and Math

- Solid waste management

- SOP

- SPA 7th

- Spanish

- Specific references to the texts (movie + reading)

- Specified on file attached.

- Specters

- Spectroscopy

- Speech

- Sports Management

- SPSS

- SPSS or EXCEL

- SPSS Project

- SQL

- SSps

- standard

- Standard Edited English

- Standing Waves

- STATA

- Statistics

- Statistics 2 graduate level

- STN ISO 690

- Strategic Management & Planning

- Strayer Standard Writing

- Strayer Writing

- Strayer Writing Standard

- Strayer Writing Standards

- Strayer Writing Standards (SWS)

- Submit as a PDF file upload. Document should use Times New Roman 12-point font, be single-spaced (with spacing between section

- suppression report

- SWS

- Systems Analysis and Design

- Systems Engineering

- tableau

- Taxes

- ted talk

- TEEL

- Telecommunication Engineering

- Test

- the 20th Bluebook citation

- The Author-Date citation style (i.e., Yung 2009, 12) is sufficient. A well-supported essay should make 10–20 references.

- The format is in midterm document, plz check it

- The format is there in requirements.

- The teacher never mentioned a format

- This is a poster

- this is a survey

- Time series

- times new roman 12 double spaced

- times new Roman 12 point font

- times new roman, double spaced 12 pt

- Times Roman size-16

- to add an image of your circuit as well as calculate current, voltage and resistance value W/ online stimulator

- Training documents

- Trends in Contemporary American Education and Florida Code of Ethics

- Typed, single spaced, 1000 words. Read “moral isolationism (pg 25-28) https://book-finder.site/book.php?i=17&g=book&b=446252&n=

- UL harvard style

- Uncategorized

- Unconstrained Optimization,Rosenbrock

- Undergraduate

- Undergraduate

- undergraduate freshman admission essay

- UoS Havard

- urban planning

- URL

- US History

- Vancouver

- vancouver reference

- Vancouver reference style

- Vancouver referencing style

- Vancouver style

- vancouver style see my files

- vim

- Visual Basic .NET

- visual studio

- Visual Studio Code

- Website designers

- website URLs

- Websites, web programming

- Westminster Harvard Referencing Style

- Woman's study

- word

- Word – Excel

- Write a page and half, use times new roman, font size 12, and 1.5 line spacing

- Write up

- write well-edited paragraphs describing your chosen artist. Be scholarly, thorough, and specific. What interesting things did y

- Writing

- Xrays and Ct scans

- You are tasked with writing a report on Toyota’s operations and how they led to the recall of millions of cars

- You will cite these sources using internal citations (example below). Example of internal citation: Franklin Roosevelt’s own ba

Meta

Why Choose Us

- 10+years of experience in the custom writing market

- Satisfied and retuming customer

- A wide range of service

- 6-hour delivery available

- Money-back guarantee

- 100% privacy guaranteed

- Writers are MA/MS or Ph.D degree holders

- Only custom-written papers

- Free amendments upon

- Сonstant access to your paper writen

We Accept

Paper Features

- Chose the font you want

- State the Referencing Style

- Normal font size is 12

- 275 Words Double Spacing

- 550 Words single spacing

- One Inch Margins

- Left Text Alignment

- Home

- About Us

- Contact Us

- Our Guarantees

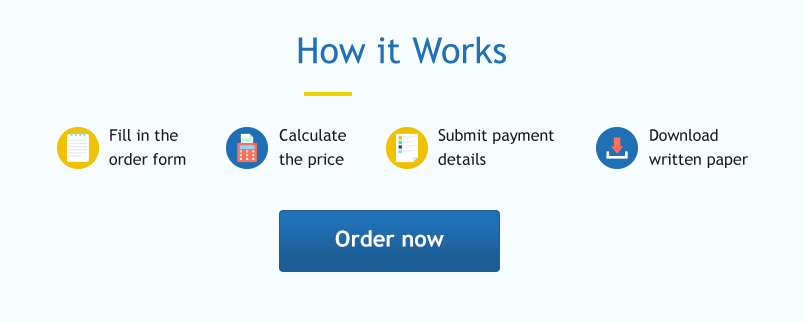

- How it Works

- Order

- Our Writers

- Services

- Term Papers

- Academic Writing Services

- Admission Essays & Personal Statements

- Coursework Writing Services

- Custom Book/Movie Reviews

- Dissertation/Thesis Writing Services

- Editing and Proofreading Services

- Essay Writing Services

- Online Classes and Homework Help

- Research Paper Writing Services

- Term Paper Writing Services

- Term Papers

Copyright © Informative Papers -

Powered by WordPress | Designed by: Premium WordPress Themes | Thanks to Themes Gallery, Bromoney and Wordpress Themes

May 5th, 2022

May 5th, 2022

Posted in

Posted in